Investing in the stock market trading has become more easily available in the fast-paced financial environment of today. As digital platforms have grown, you may now purchase shares from the convenience of your house. But opening a demat account is very essential before you enter the fascinating realm of investments. Having a demat account is crucial for the following reasons, which also changes your trading experience.

1. Seamless way to store shares:

The times of actual share certificates are long gone. Your shares are stored securely and hassle-free on a demat account created online. Everything is kept electronically, from equities to bonds to mutual funds, therefore lowering the danger of loss or damage. This is your initial step towards effectively online share purchase.

2. Simplifies Trade in Stock Markets:

Between your bank account and the stock exchange is a demat account. This arrangement guarantees speedy settlements and simplifies share buying and selling. Open trading account complements your demat account, therefore ensuring seamless and stress-free stock market trading experience.

3. Availability of Several Investment Prospectuses:

Using a demat account lets you not be limited to stocks. Bonds, exchange-traded funds (ETFs), government securities, even commodities are among the investments you might make. Combining it with the finest trading apps allows you the freedom to diversify your account and investigate several investing paths instantly.

4. Monitoring Investments: Easyness

Following your investments has never been more simple. Most demat account applications have comprehensive dashboards allowing you to check your holdings, review past performance, and examine market trends. When engaged in stock market trading, this transparency helps to improve decision-making.

5. Safety and Economies of Cost:

Along with maintenance expenses like stamp taxes, physical shares carry theft or fraud concerns. A demat account provides a safe and affordable method of asset management and storage, therefore removing these problems. Many sites also allow you build a trading account at low fees alongside your demat account.

6. quicker transactions:

In the realm of stock market investing, timing counts absolutely. Faster and more effective transactions made possible by a demat account Online rapid purchase of shares allows you to profit from market possibilities as they present. These trades are finished in a few clicks by integrating sophisticated trading apps, therefore providing a competitive edge.

7. Corporate Benefits’ eligibility:

Having a demat account guarantees that you would automatically get stock splits, bonuses, and corporate advantages including dividends. This automated system guarantees you never to miss any benefits from your investments and saves you time.

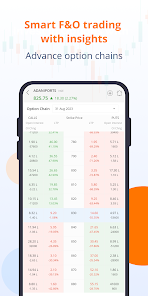

8. User-Friendly Trading Tools:

Most brokers offer simple trading apps with market updates, investing insights, and instantaneous transactions that link with your demat account. These programs are meant to appeal to both novice and experienced traders, so stock market trading is more easily available than before.

Opening a Demat Account: Steps

Starting easy is all. All you need to open a trading account and link it to a demat account is standard paperwork including your ID proof, PAN card, and address proof. Select a trustworthy platform that guarantees all the tools required for wise investments by providing smooth connection with a demat account app.

Conclusion:

Anyone wishing to buy shares online or engage in stock market trading must have a demat account; it is not only a need. It provides security, simplicity, and a number of tools to streamline and reward your investment path. Combining your demat account with the most recent trading applications will help you to have a flawless and effective trading experience. Opening a demat account will start now and move you towards financial success.