Banking apps make it simpler and more effective to manage your funds in the modern digital age. With the ease of their smartphones, users may manage their finances with these applications’ variety of banking services. With the capabilities these applications offer, managing your personal finances, tracking every dollar you spend, or even just getting a loan, is made easier.

Simple access to financial services

The ability to obtain banking services without going to a physical branch is one of the main benefits of utilizing a banking app. You can do everything with your phone, including applying for a money loan and paying bills and transferring money. Applying for a loan with clear conditions and adjustable repayment options is quick and easy with these applications. Because the process is simplified, users save time and don’t have to deal with extra inconvenience.

Easy tracking

Keeping track of every dollar is essential to preserving financial stability. Banking apps allow users to monitor their spending habits and make informed decisions. These apps classify your spending, show you your balance in real time, and even send you notifications when you are about to go over your budget. You can account for each transaction and make changes as necessary thanks to this functionality. Users may remain on top of their fiscal objectives and prevent needless debt by maintaining track of every dollar.

Handling personal finances

Among these apps’ most beneficial features is their assistance with managing personal finances. The software provides you with an in-depth understanding of your revenue, savings accounts, and expenses by combining all of your financial activity into one location. The app offers full visibility into your financial activity, whether you’re tracking investments, managing debt, or putting up savings objectives. With automatic savings tools, customers may easily accumulate wealth over time and maintain financial organization.

Easy loan options for cash

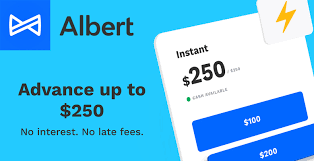

These applications provide for a quick and easy way to submit an application for a money loan if you find yourself in need of more dollars. Because everything is done through the app—from request to approval—the procedure is more efficient and convenient than with more conventional approaches. Users are able to borrow money responsibly and make sure they satisfy their financial demands without going over budget by taking advantage of simple repayment options and low fees.

Conclusion:

In conclusion, banking apps have completely changed how people handle their personal finances by providing a number of necessary financial services, such as instantaneous tracking of income and expenses and money loans. using a few touches on their smartphone, consumers can manage their finances from anywhere using these convenient apps. These apps offer the resources required to make wise financial decisions, whether it’s budgeting, tracking every dollar, or loan applications. In addition, they provide customers with financial data and flexible payback choices to help them monitor their spending and saving patterns.

Banking apps simplify these procedures, which enhances financial oversight and makes it easier for people to reach their long-term objectives. In today’s digital world, these apps are essential because of their growing significance in allowing users to make more informed financial choices and encouraging financial literacy.