One of the best ways to build wealth in India is through mutual funds. Whether you’re a beginner or an experienced investor, choosing a mutual fund needs careful consideration of your financial goals, risk tolerance, and investment duration. With so many mutual fund options, choosing wisely can affect your financial destiny. Share market apps India and online trading app platforms make investing easier than ever thanks to technology. You must grasp the elements that determine which mutual fund is best for you before investing.

Determine Financial Goals

Define your financial goals before buying a mutual fund. Debt mutual funds are safer and more stable for short-term savings like vacations and emergency funds. Equity mutual funds can provide significant returns over time, making them excellent for long-term asset growth. Investors seeking retirement or a consistent income may consider hybrid funds, which combine equity and debt.

Be aware of your risk tolerance

Risk tolerance is crucial when choosing Indian mutual funds. Equity mutual funds have strong growth potential if you can handle market changes. Stable debt mutual funds offer lower volatility and consistent returns for conservative investors. Hybrid funds combine equity and debt, making them ideal for moderate risk. Understanding your risk tolerance will help you choose a fund that fits your investment strategy.

Assess Fund Management and Performance

Before investing in a mutual fund, check its performance. While previous returns do not guarantee future profits, a fund that has performed well for five to 10 years indicates competent management and strategy. Fund management competence is also vital. Skilled fund managers with a track record of effective investment decisions can boost fund performance. Researching the fund manager’s history and investment techniques can help you decide.

Comparison of Fees and Expenses

The management fee for any mutual fund investment is its cost ratio. Comparing costs before investing is vital because a high expenditure ratio might lower returns. Investors utilize share market apps in India and online trading applications to compare expenses and choose cheap funds. If you remove your investment early, exit loads and transaction fees may apply, so check carefully to minimize excessive costs.

Study Tax Benefits

Tax considerations are crucial when choosing mutual fund investments. Long-term capital gains tax on equity mutual funds is 10% for gains over ₹1 lakh, while short-term gains are taxed at 15%. Your income tax slab determines debt mutual fund taxation. Equity-Linked Savings Schemes (ELSS) offer growth and tax benefits under Section 80C of the Income Tax Act. Understanding these tax treatments aids portfolio planning.

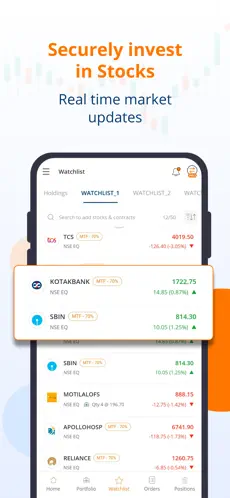

Utilize Online Trading App and Share Market Apps

Share market applications and online trading apps have made mutual fund investing in India easier as digital platforms change the financial environment. The apps give real-time market data, risk assessment tools, and automated investment features like Systematic Investment Plans (SIPs) to help investors make decisions. These digital platforms make investing any time and anywhere easy, whether you’re saving for the long term or a one-time investment.

Conclusion:

You must understand your financial goals, risk tolerance, fund performance, and tax benefits to choose the correct mutual fund. Share market apps in India and online trading app platforms have made investing easier than ever. You can comfortably invest in mutual funds in india and reach your financial goals by carefully examining your selections, comparing fund charges, and using digital tools.