Over a few years, the whole banking sector has changed a lot. This change in the personal loan industry from banks or online platforms is now a hot cake topic of the financial transformation. This situation greatly impacts the borrowers and their instant loan online over time.

Almost all major online lending platforms play a crucial role in reshaping the lending sector in India. With the help of digital advancement, shifting the lending facility based on the borrower’s interest became easier. In this article, you can explore the revolutionary trend of the digital lending platform. You will also learn the factors that change this lending trend among people.

Why are online personal loan apps in trend in India?

The first and foremost reason behind the limelight of the economy is easy availability with instant disbursal of the loan amount. In this current year, the trend is increasing significantly. Due to the no collateral fees or any other kind of security, everyone can easily apply for these instant loans online whenever needed. Besides, the repayment terms are flexible enough. Individuals can choose the most suitable repayment plan based on their financial capability. The minimum income should be INR 15,000, and the minimum age requirement is 21 years.

What crucial factors work as game changers for online personal loan apps?

The Indian financial landscape is changing due to many recent trends in the personal loan market. Personal quick loans are now easier to get by anyone at any time. Thanks to the rising popularity of digital finance, quick approvals, minimal paperwork, and top-notch customer service of those online lending platforms.

- Rising lender competition has emerged as a significant driving force behind expanding the Personal Loan market in India. This has led to improved loan options, competitive interest rates, and customer-centric strategies that ultimately benefit borrowers.

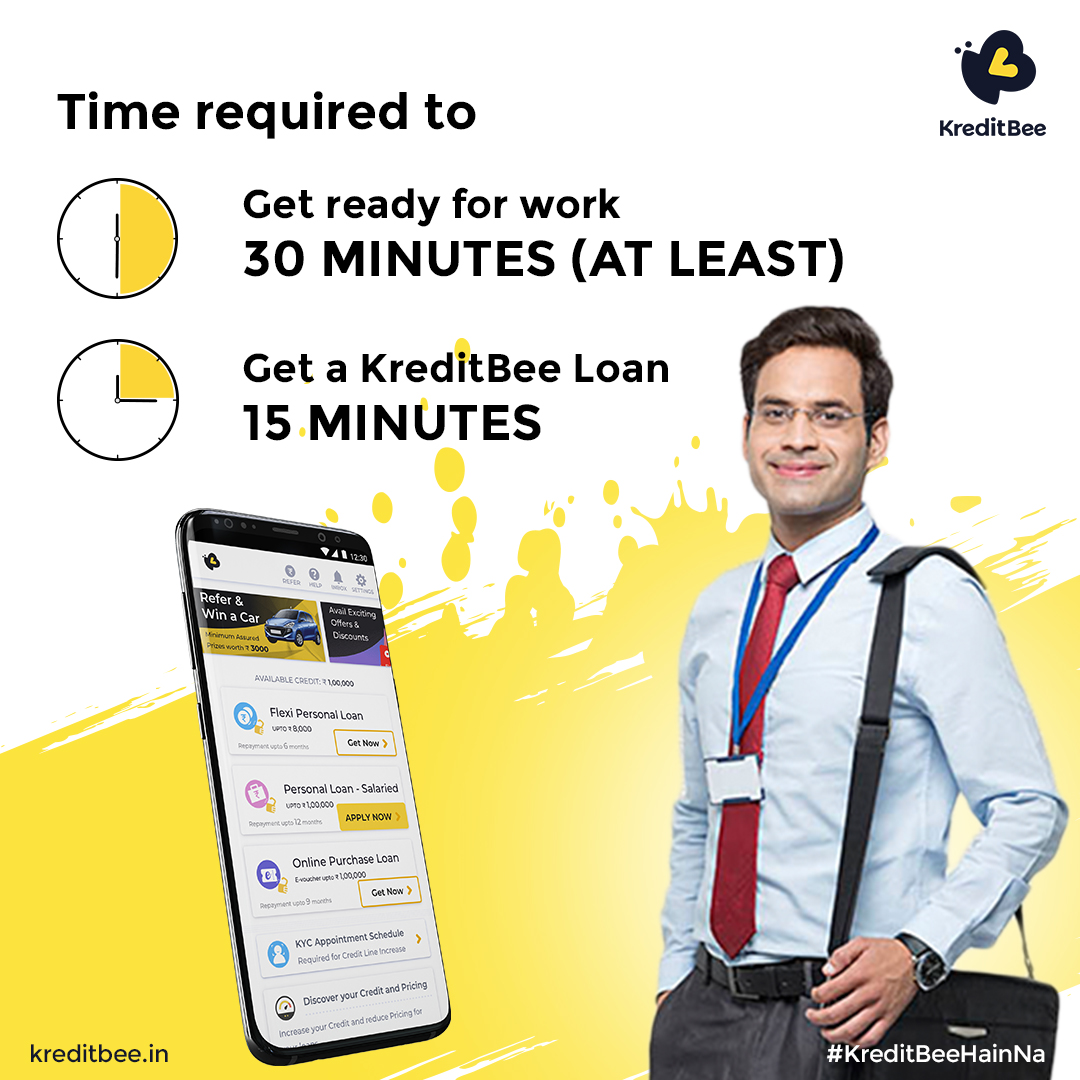

- The Personal Loan Industry in India is changing due to the online revolution. On mobile lending apps, borrowers can easily apply for loans, and upload their documents. They can also take advantage of a fast loan approval process. That means there is no chance of delaying loan disbursal.

- The EMI facility for online loan repayment systems is another reason behind the ongoing trend of online loan platforms. Flexible loan repayment features on all lending apps offer easy circumstances for a suitable plan for everyone.

- Credit scores are beneficial for financial opportunities. Borrowers can easily raise their credit scores with personal loans. By responsibly repaying the loan amount, they can build their good creditworthiness. In the future, they can get more financial benefits.

- There is no need to showcase the reason to avail of personal loans anytime. Without any hassle, individuals are allowed to apply for the loan.

- Online facilities guarantee a streamlined experience for all borrowers with basic Know Your Customer (KYC) data. These lending apps aim to make Personal quick loan applications more convenient by streamlining documentation. It also saves all customers valuable time and effort.

Conclusion:

The whole Indian lending sector is changing rapidly with the help of the digital revolution and customer demand and financial behaviors. In recent days, a lot of online platforms are assisting borrowers. With all of those key factors, the Flexi loan sector in India is expected to experience huge growth in the upcoming days.