Sometimes, life throws financial curveballs. Whenever emergencies arise, they tend to put unnecessary financial pressure on you, and then you are soon scrambling for solutions. Ideally, the best option to fall back on is having a strong emergency fund; however, there are occasions when you need cash and in a short period. This is when short-term personal loan could form a financial bridge that helps you fill up temporary income gaps.

Understanding short-term loans

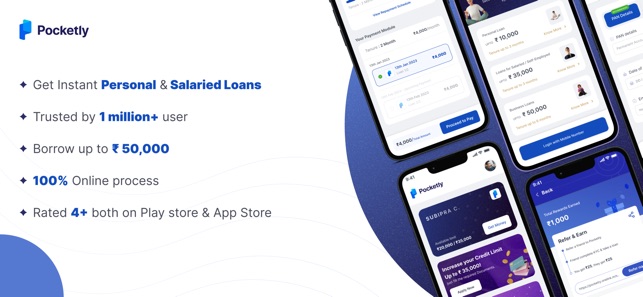

Short-term loans are the type of financial credit that grants rapid access to a relatively small amount of money. It amounts from a couple of hundred to a couple of thousand bucks, unlike traditional credit programs with a repayment period of several years. Their unique quality lies in the timeframe for loan repayment in a few weeks or months, allowing borrowers to obtain cash quickly. Meanwhile, these programs may feature high interest rates. You can also check personal loan apps like Fibe.

Instances in which short-term loans might be helpful

Despite not being a long-term solution, short-term loans can be advantageous under the following conditions:

- Covering Unexpected Expenses: Unexpected expenses can include the need to repair a household appliance, an automobile breakdown, or unexpected medical bills. To avoid falling behind in payment of other bills, pay off the headlight.

- Bridging the Gap Between Paychecks: In many cases, the paycheck adds up to a sufficient balance, so a salaried personal loan can cover your top goods, groceries, housing bills, or a difficult discount to hold out until the next payday arrives.

- Consolidating Debt: For someone with significant debt on high-interest credit cards, a loan with a lower rate could make it easier to consolidate and get the debt under control.

Certain considerations to keep in mind prior to borrowing

Although short-term loans provide a quick opportunity to get cash, you need to be extremely cautious when using them:

- Rates and Fees: Short-term loans may feature extremely high interest rates and fees. Be sure to examine the annual percentage rate and origination fee to know the full cost associated with borrowing. Use personal loan apps like cashe.

- Ability to Pay Back: Only borrow if you can fairly easily meet half of the loan’s repayments. Missing any payment may result in more fees and a hit to your credit.

Using short-term loans responsibly

In case you go for a short-term loan, choose these measures to be a responsible lender:

- Shop Around: Compare rates and loan terms from several lenders and consider those with transparent terms and fees.

- Borrow What You Need: Borrow only what you can afford to pay back in a set period.

- Create a Repayment Plan: Create a repayment plan by determining the monthly amount you will put away from your income to repay the loan. The best way is to set up an automatic deduction in your checking account to avoid missing a payment. This will make your creditline strong.

- Focus on Long-Term Solutions: While taking out a short-term loan is a good option for immediate needs, start putting money aside in your savings and creating an emergency fund to prevent the need to resort to short-term loans in the future.

In summary, short-term loans can be the perfect tool for a financially literate person. By managing the risks and acting carefully, they can become a means to cover a temporary financial vacuum and remain financially solvent.