In today’s digital-first world, managing money has evolved far beyond just spending and saving. Modern users now seek a system that does both — instantly. That’s where a Daily Investment App comes in. Imagine a UPI app that grows your money, giving you liquidity for everyday payments while ensuring your idle balance earns daily growth.

It’s not about heavy investing or financial jargon — it’s about making your daily money smarter, automatically.

What Is a Daily Investment App?

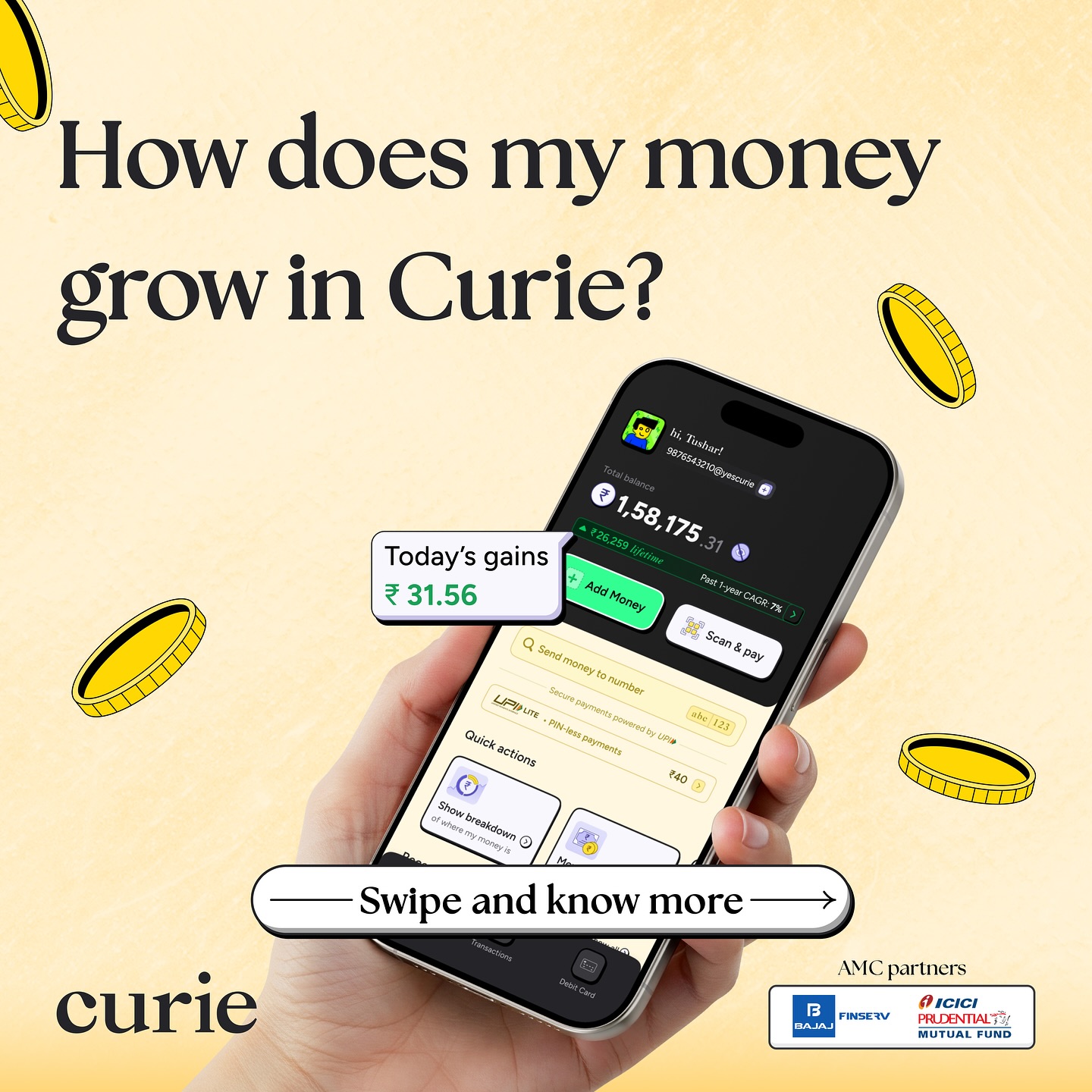

A Daily Investment App is a simple, modern way to grow your money without losing instant access to it. It connects your UPI balance to liquid fund–linked savings, allowing your funds to earn daily growth while staying spendable anytime.

Think of it as a spendable savings account — your money is always ready for a quick UPI payment, but it’s also growing quietly in the background.

You don’t need to open a new bank account, fill out forms, or lock your funds. Everything happens automatically within your existing UPI app.

The Evolution of Digital Money Management

The rise of online investment apps has changed how we view financial growth. In the past, investment meant setting aside large amounts, choosing funds manually, and waiting for returns. But modern UPI-linked solutions simplify everything — they combine daily investment potential with on-demand liquidity.

Instead of idle balances sitting in your wallet, your money becomes dynamic — ready to spend, yet always earning.

This evolution reflects how people want to manage money today: simple, seamless, and smart.

Why a Daily Investment App Makes Sense

1. Your Money Never Sleeps

Most of us leave money in our UPI wallets or accounts for everyday use. But that balance just sits there. With a daily investment app, that same money works for you every day — automatically generating growth without locking it away.

You can spend, send, or transfer anytime. The difference is, your balance isn’t idle anymore.

2. Growth Without Complexity

There’s no need to study markets or pick funds manually. The app integrates liquid fund savings — a category known for short-term, low-volatility assets — so your balance can grow steadily without extra effort.

The result? Growth that fits your lifestyle, not the other way around.

3. Instant Liquidity

Traditional investments often come with withdrawal limits or waiting periods. But with UPI-based daily investment, your funds remain instantly available. You can scan, pay, or transfer in seconds — just like any regular UPI transaction.

It’s growth and liquidity together — something traditional savings rarely offer.

How an Online Investment App Works

Here’s a simple breakdown of how this system functions:

- You keep your spending balance within your UPI app that grows money.

- The app automatically connects your funds to a liquid fund–based mechanism, designed for daily growth.

- Your balance grows quietly, yet remains ready to use for any payment.

- Whenever you make a transaction, your app adjusts instantly — ensuring you never lose access to your funds.

There’s no separate process, dashboard, or manual action needed. The growth happens in the background, while your money stays at your fingertips.

Benefits of Using a Daily Investment App

1. Automatic Growth

You don’t have to set reminders or invest manually. Your idle cash earns daily growth automatically.

2. Instant Access

Use your money anytime through UPI — whether it’s for a quick recharge, a grocery bill, or rent payment.

3. Complete Transparency

You can see your growth and transaction details clearly. No hidden terms or confusing fine print.

4. Simplicity

No complex interfaces or financial jargon. Everything happens within the same UPI app you already use.

5. Smart Money Habits

It encourages smarter money management — helping you grow while staying liquid and flexible.

Daily Investments: A New Habit for a New Generation

Today’s generation prefers flexibility, automation, and visibility. Traditional savings often feel slow or outdated, while full-scale investing can seem complex. Daily investment apps bridge that gap perfectly.

You don’t need to “invest big” — even your daily spending balance participates in gradual growth. It’s like turning your everyday UPI wallet into a micro-savings engine that grows quietly while you go about your day.

Over time, these small, consistent gains make a meaningful difference.

Common Misconceptions About Daily Investment Apps

Let’s clear up a few myths:

- It’s not a risky investment. The app connects to liquid, short-term assets, not volatile instruments.

- It’s not a mutual fund distributor. You’re not buying or managing funds directly — it’s built into the app’s savings structure.

- It’s not a bank or NBFC. It simply combines payment convenience with intelligent money management.

- It doesn’t lock your money. You can spend it anytime through UPI — no waiting, no withdrawal process.

It’s a smarter way to use the same money you already handle daily — with zero extra effort.

The Role of UPI in Modern Investing

India’s UPI system has revolutionized payments — now, it’s redefining how we think about saving and growth. With UPI-integrated online investment apps, your financial journey becomes more fluid and responsive.

- Pay your bills, shop, or transfer money instantly.

- Watch your unused balance grow quietly.

- Track everything in one app — simple and transparent.

This fusion of UPI payments and liquid fund savings represents the next big leap in digital finance — where spending and investing finally coexist.

Who Should Try a Daily Investment App?

It’s ideal for anyone who wants to:

- Keep daily liquidity while earning steady growth.

- Automate small savings without extra effort.

- Avoid the complexity of traditional investing.

- Manage all money needs — spending, saving, and growth — in one place.

Whether you’re a student, a salaried professional, or a freelancer, a daily investment app adapts to your lifestyle seamlessly.

Conclusion: Experience Smart Growth with a Daily Investment App

Your money deserves to work as hard as you do — without making your life complicated. A Daily Investment App or Online Investment App brings that balance between liquidity and growth, helping you spend, save, and grow seamlessly within the same UPI ecosystem.

No more idle balances or complex investment journeys. Just smarter, automated growth that fits into your daily routine.